What is a Bridge Loan?

Minimum equity investment of up to 20%*.

In the same way that a bridge connects two sides, a Bridge Loan is a loan designed to exist between two more permanent financing options. It “bridges” the gap in lending between time periods. A Bridge Loan is perfect for borrowers with special financing needs and/or time constraints, who need to secure working capital customized for many different situations.

- Loan Purpose: Acquisition, Refinance, or Cash Out

- LTV (Loan to Value): 80% Stretch

- Loan Terms: Up to 7 years

- DSCR: Less than 1.0

- Rates: starting at 7.5% – Interest Only

- Coverage: Nationwide (in major markets)

- Amortization: Interest only during perm, but may be subject to 20-30 years during extension periods

- Must have an “Exit Strategy”

- Close quickly

Property types include Multi-Family, Mixed-Use, Office, Warehouse, Retail, Light Industrial, Restaurant/Bar, Self-Storage, Automotive, and more. CLS does not structure our loans as lines of credit, so only reasonable minimum interest periods that are aligned with your business plan are required.

Top Two Reasons to Get a Commercial Bridge Loan

Most of our commercial lending clients are interested in a commercial bridge loan for one of these two reasons:

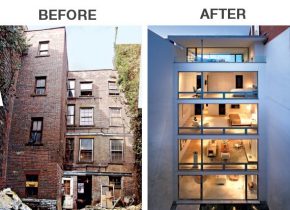

- The Building Needs Extensive Repairs – If your building is in a state of disrepair and it’s turning away customers, take back control and apply for a commercial bridge loan today.

- The Commercial Building Has Low Vacancy Rates – Do you own a multiplex that is plagued with low occupancy and high turnover rates? It’s time to turn your situation around with a hard money commercial bridge loan.

What will you need to get started?

- A Complete 1003 and Personal Financial Statement for all Borrowers

2. Executive Summary

3. Current Credit Report (within 30 days)

4. Rent Roll

5. Color Pictures of Subject Property

6. Operating Statement (Last 2 Years and Year to Date)

Ready to get started? Contact us to set up an appointment today.

*Subject to review of DSCR

Top Facts About Commercial Bridge Loans

- Commercial Bridge Loans Don’t Require Primary Residency – You can flip the property and lease it to a tenant without breaching owner-occupied contracts typically found in other loans types.

- Commercial Bridge Loans Are Quick to Process – Commercial Lending Solutions understands that time is money. Our underwriting process is quick and the application takes just minutes to complete.